Upload Ofx or Qfx Account From Bank of America

Import Online Bank Information and Auto Match Transactions in NetSuite

NetSuite offers many different banking argument functions designed to increase productivity and accurately track your income. Today we will focus on importing online information, intelligent transaction matching and reconciling depository financial institution data for your individual business organisation needs.

Nosotros will also highlight the latest supported financial institutions, bank feeds and banking improvements in NetSuite. Check it out!

Importing Online Banking company Information

In order to import banking data into your NetSuite account, you demand to first download the statement from your financial institution or credit carte company.

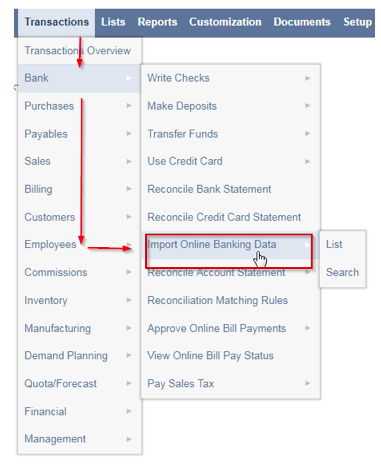

- From your dashboard click Transactions.

- Navigate downward to Bank.

- Go to Import Online Banking Information (Administrator).

- One time you lot are on the Online Banking Information Upload page, click the Cull File push and select your file.

Note: NetSuite has a l-character limit for file name and extension

- Cull the name of the file yous would like to import.

- ClickSubmit.

- If y'all would like to reference the uploaded statement, navigate toTransactions > Bank > Import Online Banking Data > List.

- To open the banking company argument click View.

NetSuite will then display the confirmation for the Online Banking Information page with the number of imported transactions and matches.

Get NetSuite Services Today

Supported file types for import

Import business relationship statements in the five following formats:

- Bank Administrative Constitute Version 2 (BIA2) txt with UTF-eight encoding

.

This format was developed by Banks describing account information, transactions, activities, securities and lockbox deposits. BAI2 Prior-Day reporting for Bank Reconciliation is supported by NetSuite and tin can contain multiple bank accounts. This format is supported for Wells Fargo, Bank of America Merrill Lynch, United states Bank, TD, and JP Morgan Chase. - CSV with UTF-8 encoding

All files with the .csv extension must follow the NetSuite CSV template constraints and be UTF-eight encoded. The CSV file can only comprise transactions that belong to a single account. - Open up Financial Exchange (OFX)

This file format is promoted by Microsoft, Intiuit, and Fiserv. - Quicken Fiscal Exchange (QFX)

This format was established by Intuit for their Quicken software. - CAMT.053.001.06 XML with UTF-8 encoding This format complies with ISO 20022, is used by SWIFT and contains finish of mean solar day bank transaction summaries for multiple accounts.

Note: As of 2018.2 the QIF file format will exist depreciated and will no longer be supported. We recommend updating your files to ane of the v to a higher place supported formats.

Intelligent Transaction Matching

NetSuite automatically matches imported statement transactions with general ledger transitions. With the concluding 2018.i update, you have the power to create unique matching rules with multiple conditions and add the order NetSuite runs them to notice matches. When you upload a statement, specify the account with a custom dominion and the Intelligent Transaction Matching feature runs and includes your new custom rules. Note: NetSuite merely runs the rule against transactions for selected accounts.

How to create a new matching rule in NetSuite:

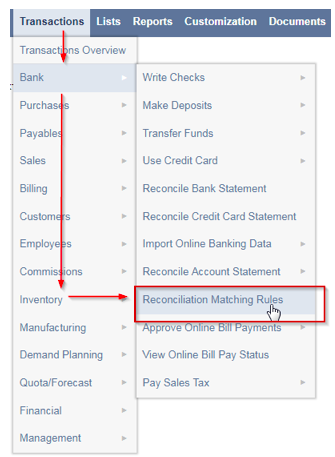

ane. From your dashboard click Transactions.

2. Navigate downwardly to Banking concern.

3. Go to Reconciliation Matching Rules.

4. Under Custom Rules, click New Rule (the accounts subtab defaults to automatically open up).

v. Enter a Custom Rule Name for your new matching rule (required field).

six. Filter Options: Note: Different permissions to view and edit accounts are set based on your user role. Notify your ambassador to edit reconciliation permissions.

Bear witness Included Only – This will narrow down your list to just included accounts

Business relationship Type – This will filter simply by type of account

Search Field – Enter account blazon, business relationship name, description or currency

7. Check the box for the account with the custom rule.

8. Select the first transaction type from the Transaction Type list for this rule condition. Your selected transaction determines which options are available in the primary field and the Transaction Type list.

9. Select the starting time field on the Main Field List (the list options depend on the selected Transaction Type).

Note: Memo Pick – The memos in the NetSuite transactions lists are the memo values from the Check Headers or Journal Entry. Transactions cannot be grouped by the value in the memo.

10. Select an operator for the matching rule from the Operator list.

Operators include:

Equals – Selected fields must be equal.

Equals (Ignore Prefix) – Selected fields must be equal, but ignores leading zeros or prefix messages.

Within x Previous Days of – The number of days a date match tin vary.

Before – The Selected transaction type date can be before the imported date.

Afterwards – The selected transaction appointment can be after the imported date.

11. In the Value field, enter the alphanumeric value (Equals, Equals (Ignore prefix) etc).

12. If not selected by default, select the 2nd Transaction Type listing which volition give you which options are available on the list.

13. If not selected by default, select the field where the system creates its matching rule condition from the Compare Field list. This must be the same date as the main field.

Note: Memo Option – The memos in the NetSuite transactions lists are the memo values from the Check Headers or Journal Entry. Transactions cannot be grouped past the value in the memo.

14. Select the add/delete icon to add together/delete an extra condition.

fifteen. Click Relieve to save and create a new custom dominion. For your reference, this dominion will now exist under the Custom Rules heading.

16. Drag and drop the rules into the order you lot similar.

Now you are set up to rock and roll! The next time you import your next statement, the Intelligent Matching feature will run and include your new custom rules.

Advanced Bank Reconciliation for NetSuite

Avoid the tedious, time-consuming monotony of manually entering information from multiple depository financial institution accounts. Advanced Banking concern Reconciliation will assist speed upwardly the bank reconciliation process and keep your NetSuite account efficient and authentic. Transactions are effortlessly tailored to produce user-definable rules with flexible matching directly imported from the bank into NetSuite. ABR takes minutes to fix up, works with all international banking company statement formats, reduces errors, and allows you to create templates to memorize transactions.

Reconcile your bank Statement:

ane. From your dashboard click Transactions.

two. Select the account you are balancing in the Account field.

three. Select Reconcile Bank Business relationship The Last Reconciled Banking company Argument field is the remainder of this corporeality from the last time you reconciled a statement from your bank.

4. Statement Date – Choice the date of the statement.

5. Start Date – Enter the start of the reconciliation period.

vi. Ending Argument Balance – Enter the statement endmost residuum.

Note: NetSuite subtracts the combined amounts of the Concluding Reconciled Remainder and Reconciled This Statement from the Ending Statement Balance.

To select the number rows in list segments that display on the home page at home >set preferences >general > number of rows in listing segments.

Holding a Reconciliation

NetSuite has the power to agree and save your bank argument reconciling transactions until you are finished processing. Click Hold on the Reconcile Credit Card / Reconcile Bank Argument pages to concur your reconciliation. When you return to complete reconciling your statement, the recently entered transactions proceed to exist selected. Reconciled transactions placed on hold remain unreconciled until they are saved.

Bank Feeds & Banking Improvements

Instead of managing every single bank transaction, NetSuite has streamlined the process by allowing businesses to automatically import transactions and balances from the depository financial institution directly into NetSuite without importing files. Save time, treasure and talent past integrating NetSuite directly to your bank. Check out the latest cyberbanking questions that NetSuite users are asking nigh the latest release.

NetSuite Banking FAQ:

- What is the divergence between the latest Bank Feeds SuiteApp and the Bank Statement parsers / Bank Connectivity bundles?

– The Bank Feeds SuiteApp does not require a manual process for uploading data into NetSuite equally it auto-imports transactions straight from your bank. The new SuiteApp is also express to Canada and Usa-based banking institutions.

- When tin I admission the Depository financial institution Feeds app?

– The SuiteApp has been available since the 2020.i release.

- What banks and financial institutions are supported?

– NetSuite supports thousands of financial insitutions and banks with the latest release. To narrow it down, hither is a loftier level overview of the largest banks on the list. Interested in learning if your banking company is supported? Cheque out the complete Bank Feeds listing here.

- Wells Fargo HSA Banking company

- Chase J.P.Morgan Commercial Card

- Bank of America Merrill Lynch (Global Card)

- US Bank (SinglePoint)

- Wedlock Bank of Mena

- Citibank Drive Card Credit Card

- Banking company of the W

- Mechanics Bank

- California Bank & Trust

- East West Bank

- Westamerica Banking company

- Tri Counties Banking company

- Umpqua Banking company (CA) Business organisation Banking

- Pacific Western Bank (Business Bank)

- OneWest Bank

- BBVA Compass Spend Internet Navigator

- Citizens Business organisation Depository financial institution

- Urban center National Banking company (ePartner)

- Outset Republic Bank

- Offset Citizens Bank

- Fundamental Valley Community Bank

- HomeStreet Bank

- Exchange Bank

- Bank of Stockton

- Starting time Foundation Bank

- Oak Valley Community Depository financial institution

- United Business organization Bank

- Heritage Bank of Commerce (Business)

- Royal Business organization Banking concern

- First United Security Bank

- Marcus by Goldman Sachs

- TD Banking company

- Capital One

- …and much more than.

- What practice I do if my bank isn't listed or supported by the Banking concern Feeds SuiteApp? Can I add my bank to the list?

– If your bank is non listed/supported, y'all volition need to connect with a custom connectivity plugin or utilize the Bank Connectivity SuiteApp 285204.

- Do we have the ability to access a demo bank server to sympathise this procedure further?

– Demo accounts are not offered.

- Does 2FA enforce an edit at every log-in? Do we accept the ability to access a demo bank server to understand this process further?

– Depending on your financial establishment, a multiple gene security code is manditory upon every login.

- Tin can yous customize the import schedule to numerous imports per twenty-four hour period?

– Import customizations are not bachelor.

- Will the refresh of my Sandbox effect the connection in production?

– Your Sandbox will only be impacted if updates are made in the Format contour (linking / unlinking accounts)

- Will the connectedness automatically transport GL transactions?

– GL impacting transactions are not automatically imported. It is manditory for your bank data to be matched to prevailing GL transactions.

- Can I create a NetSuite search or study on my unmatched transaction activites?

– Saved search allows users to view uncleared transactions.

SUPPORTED Financial INSTITUTIONS AND BANKS:

To assistance your organization make a smoothen transition into the 2021.1 release, our v-star NetSuite squad is hither for yous. Have questions? Our consultants are available for on-demand services without service tiers or minimums. Read more than well-nigh NetSuite Bank Feeds with our recent Bank Feeds Essentials blog.

Interested in finding out more than about how NetSuite tin can help automate your cyberbanking process?

The truth is, nosotros've simply scratched the surface! Please contact us for a quick sit-in and make sure to check out other helpful tips, tricks and how-to's on our NetSuite tips blog.

Whether you are looking for a one-stop-store for all things NetSuite, or just need answers to your questions, our laurels-winning NetSuite experts are here to make your business concern meliorate. We provide support, administration and process optimization to ensure organizations get a render on their investment.

Get NetSuite Services Today

Follow us on Social for NetSuite tips, tricks and ERP fun:

YouTube, LinkedIn, Twitter, Pinterest, Instagram, and Facebook

READ MORE

- NetSuite Demand Planning Implementation & Optimization Services

- NetSuite YouTube Video Roundup

- NetSuite User Group

- Sneak Peek: New Manufacture-Specific Features of NetSuite Release 2020.2

- What types of users are bachelor in NetSuite?

- The Ultimate Guide to NetSuite Modules

- How to create, edit and manage custom KPIs

- NetSuite Services List

- Why Protelo?

Source: https://www.proteloinc.com/blog/import-online-bank-data-and-auto-match-transactions-in-netsuite/

0 Response to "Upload Ofx or Qfx Account From Bank of America"

Post a Comment